Dissolution and liquidation are two ways to formally close a UK limited company. However, these procedures are very different from one another and serve different purposes. Choosing between dissolution and liquidation depends on the company’s financial position, assets, liabilities, and trading status.

Key takeaways

- Company dissolution and takeaways are two separate methods you can use to close down a UK limited company.

- Liquidation is required if your company has debts or assets that need to be settled. It involves a licensed insolvency practitioner and takes 6–24 months.

- Company dissolution is a more straightforward and more cost-effective option for closing a solvent company with no assets or debts. It usually takes 2–3 months and can be approved by the directors.

What is company dissolution?

Company dissolution is the standard way to voluntarily close or remove (“strike off”) a company from the Companies House register. This is relevant when the business is no longer trading and has no debts or assets.

When can you dissolve a company?

The Companies Act 2006 sets out the eligibility criteria for company dissolution in sections 1004 and 1005. These conditions include that the company:

- Has not traded in the last three months

- Has not sold off any of its assets or stock in the last three months

- Has not changed its name in the last three months

- Is not threatened with any insolvency proceedings, e.g. compulsory liquidation (see below for more information)

- Does not have any agreements in place with creditors (the people or organisations the company owes money to)

Overall, this means a company can’t simply choose to dissolve whenever it wants.

For example, a garden centre is looking to close down, with the owner wanting to start a new venture in a new industry. On 15 January 2026, the shop ceases to trade, and on 31 May 2026, they remove the last remaining assets out of the company (some unsold gardening equipment that was part of their stock).

Assuming all other dissolution criteria have been met, the company can only apply to strike off on 1 September 2026 onwards, as this marks more than three months from the last time it sold off any assets (the first of the conditions set out above). The date they ceased to trade is irrelevant, as they continued to sell and dispose of property afterwards.

- How to close a company online

- Should I close my limited company or make it dormant?

- How to value your small business – and why it matters

Business owners often assume that ceasing trading is a key factor in determining whether and when they can close down. However, it depends on several criteria, including a 3-month breathing space between the final date of trading and/or the transfer of assets. It’s crucial to be clear about what’s happening in your company, even when you’re looking to close.

The company dissolution process explained

The procedure for dissolving and striking off a company is simple and normally takes 2-3 months to complete.

1. The directors agree to strike off the company

Provided the company meets the eligibility criteria, the directors must agree to submit an application to Companies House. You must then inform interested parties (including shareholders, HMRC, creditors, and any employees) of your intended application.

2. A dissolution application is submitted to Companies House

The Form DS01 is used to apply for voluntary dissolution at Companies House. This form should be signed by a majority of the directors, if more than one is appointed. A filing fee of £13 is required. Submission by post is possible for £18, but only do this if you can’t file online.

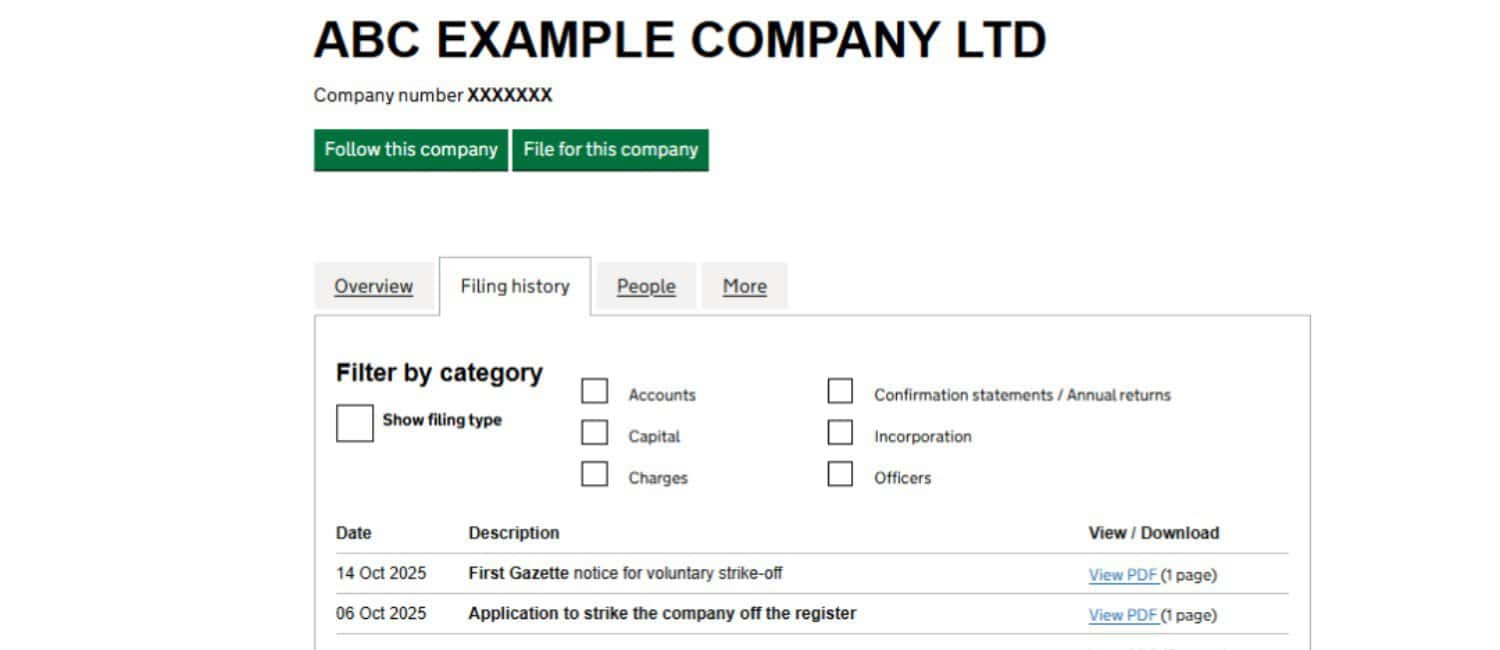

3. Dissolution application is processed, and the first Gazette Notice is published

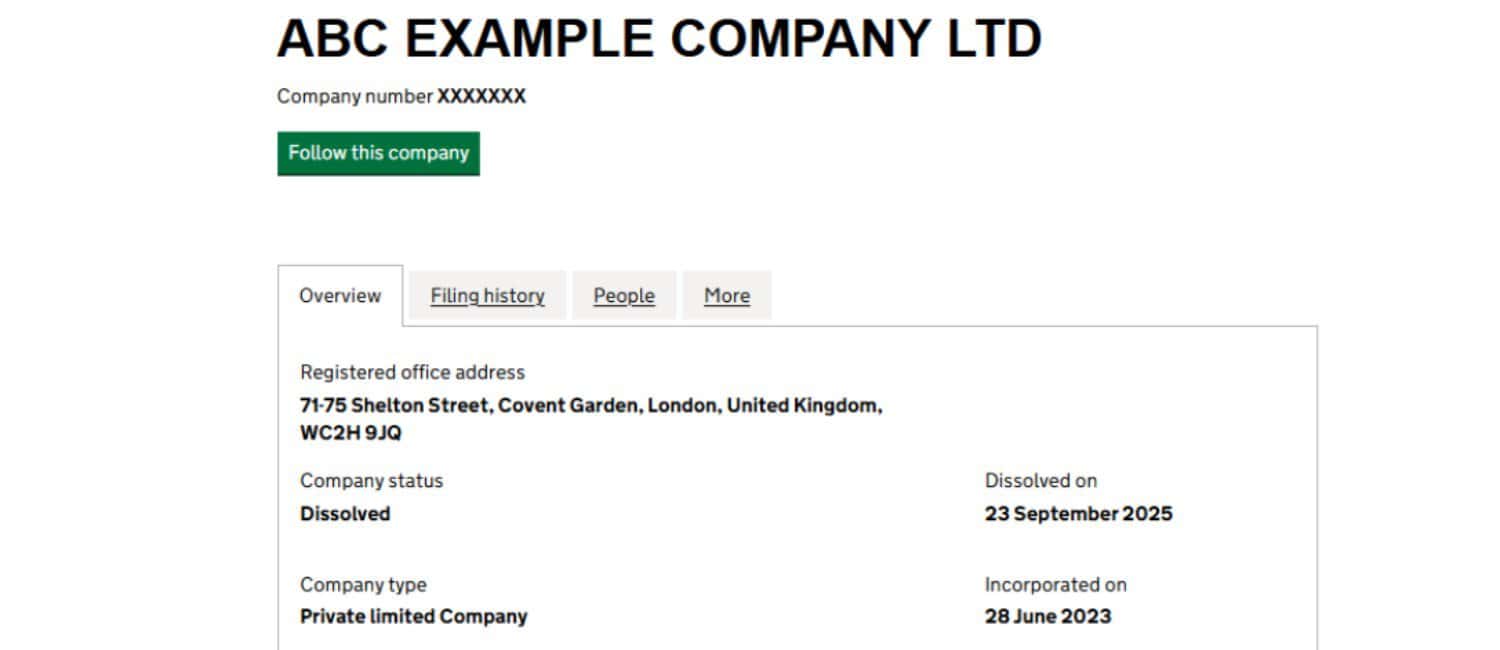

Once your application has been approved by Companies House, a notice will be published in The Gazette (the UK’s official public record for legal notices). It will also appear in your company’s filing history. The purpose of this notice is to give the interested parties a chance to object to the company being struck off (for example, if your company owes them money). You will also see the company’s “status” change from “Active” to “Active proposal to strike off”.

4. The company is closed

Two months after the first Gazette notice – if no objections are raised – a final notice is published. As soon as this is done, the company is considered to be closed down and no longer exists.

Why it’s important to get the dissolution process correct

Care must be taken when dissolving a company because there are rules in place to protect shareholders (members), creditors, employees, and anyone else who is likely to be affected by company dissolution. All such parties must be given notice of the company’s intention to strike off before an application is made.

Failure to do so is an offence that can result in significant fines and director disqualification. And if directors fail to notify affected parties with the intention of concealing the strike off application, they can face up to seven years’ imprisonment.

What is company liquidation, and when is it required?

Company liquidation is more complex than striking off a company. It is a process where a “liquidator” is appointed to take control of the business, sell its assets, repay debts where possible, and distribute any remaining funds to shareholders before the company is closed down.

The appropriate type of liquidation depends on whether your company can pay its debts. The three main types are:

- Members’ Voluntary Liquidation (MVL) – this is used when the company is solvent (it can pay its bills) but the shareholders wish to wind up the business.

- Example: the owner and director of a company wishes to close up shop so they can retire.

- Creditors’ Voluntary Liquidation (CVL) – the company is insolvent (unable to pay its bills) and the directors and shareholders elect to voluntarily liquidate the business in order to pay the company’s debts.

- Example: Wilko, a British high street store founded in 1930, experienced a prolonged decline throughout the 2010s, characterised by reduced footfall, slow adaptation to online retailing, and rising operational costs. After first being placed into administration, the company eventually entered a CVL in August 2025.

- Compulsory liquidation – the company is insolvent and is forced into liquidation under a court order.

- Example: Thomas Cook, an airline and tour operator headquartered in the UK with roots going back over 170 years, was placed into compulsory liquidation by the courts in 2019 after failing to secure emergency funding. This followed years of challenges, including a high debt burden, changing customer preferences, and intense competition.

What does the liquidator do in a liquidation?

When a company enters liquidation, the appointed liquidator will take control of the business. When this happens, the directors no longer have control over the company’s operations and assets, so they cannot act for or on behalf of the business.

From that point, the licensed liquidator is responsible for all matters related to the company’s wind-down, including carrying out functions necessary to dissolve the company. This includes carrying out the following:

- Interviewing directors and reporting on the reasons for liquidation

- Reviewing the company’s assets and liabilities

- Dealing with all paperwork and filings

- Liaising with creditors and authorities

- Disposing of (selling) the company’s assets to pay its creditors

- Settling any legal claims and outstanding contracts

- Paying liquidation fees and the company’s final tax bills

- Getting the company struck off the register at Companies House.

Who gets paid when a company is liquidated?

When a company is liquidated, any money made from selling assets goes toward repaying debts. If the business is insolvent, creditors are paid in order of priority, starting with secured creditors (a lender with a legal right over specific company assets if debts aren’t repaid).

Once closed, any remaining debts are written off, unless the directors have given personal guarantees. If the company is solvent, all debts are paid, and any remaining funds are distributed to shareholders.

How to get started with company liquidation

To initiate the liquidation process, the company’s directors must first determine the appropriate type of liquidation. In both a Members’ Voluntary Liquidation and a Creditors’ Voluntary Liquidation, the process is initiated by the directors and must be approved by the shareholders. A licensed insolvency practitioner is then appointed to manage the winding-up. Compulsory liquidation is different – it’s usually forced by a creditor applying to court to close the company due to unpaid debts.

Whichever route you take, the earlier you engage a qualified insolvency practitioner, the smoother the process and compliance with legal requirements will go.

Dissolution vs. liquidation: What’s the difference?

While both dissolution and liquidation are ways to close a company, they differ significantly in process, cost, and eligibility. Here’s a side-by-side breakdown of the differences between these two closure routes.

| Factor | Dissolution | Liquidation |

|---|---|---|

| Eligibility | Only for solvent companies with no remaining debts | Suitable for both solvent and insolvent companies |

| Process initiated by | Company directors with shareholder approval | Dependent on the type of liquidation. |

| Involves a liquidator? | No | Yes. Must appoint a licensed insolvency practitioner |

| Asset distribution | Assets must be transferred before dissolution | Assets sold and proceeds used to pay creditors, as part of the process. In solvent companies, any remaining assets are then distributed to the shareholders. |

| Timeframe | Around 2–3 months | Usually 6–12 months, but can take longer, depending on complexity |

| Cost | Just £89.99 plus VAT to strike off with Quality Company Formations | Depends, however, typical costs range from £1,500 to £3,000+ for a Members’ Voluntary Liquidation. |

| Reporting and submissions | Form DS01 only | More extensive, including formal reports and notifications |

| Normally suitable for | Dormant or unused solvent companies | Companies with debts or complex affairs to settle |

An alternative to closure: Dormant company status

If your company isn’t ready to close but isn’t actively trading, marking it dormant can be a practical alternative. A dormant company is one that’s not actively trading and has no significant accounting transactions.

To maintain dormant status, you must:

- File an annual confirmation statement

- File annual accounts (if you meet the eligibility criteria, you will normally be able to submit dormant company accounts)

- Tell Companies House of any changes or updates to your company

- Inform HMRC of your dormancy status

Placing a company into a dormant state is a helpful option if you plan to use the company again in the future or want to protect a company name (so no one else can use it). However, it does entail some ongoing administrative costs. So, if you’re asking yourself, “Should I close my limited company or make it dormant?” you need to weigh up the cost and administrative advantages, as well as your plans for the future.

If you wish to keep your company dormant, our Full Company Secretary Service is ideal for you. We’ll take care of all your confirmation statements, dormant company accounts, and updates to Companies House. We’ll also provide you with a templated letter you can send to HMRC to inform them of your dormancy status (provided you meet the relevant criteria).

Ready to act?

Understanding the distinction between company dissolution and liquidation is crucial for making the right decision for your business. Dissolution is quick and low-cost for solvent, inactive companies, while liquidation is a formal process better suited to businesses with debts or remaining assets. If you’re ready to dissolve your company, our Company Dissolution Service offers a fast, professional solution. For those considering liquidation, we recommend speaking to an insolvency expert.

Alternatively, if you’d like to keep your company in a dormant state, our Full Company Secretary Service can help you stay compliant with annual filing requirements while maintaining its inactive status.

Join The Discussion