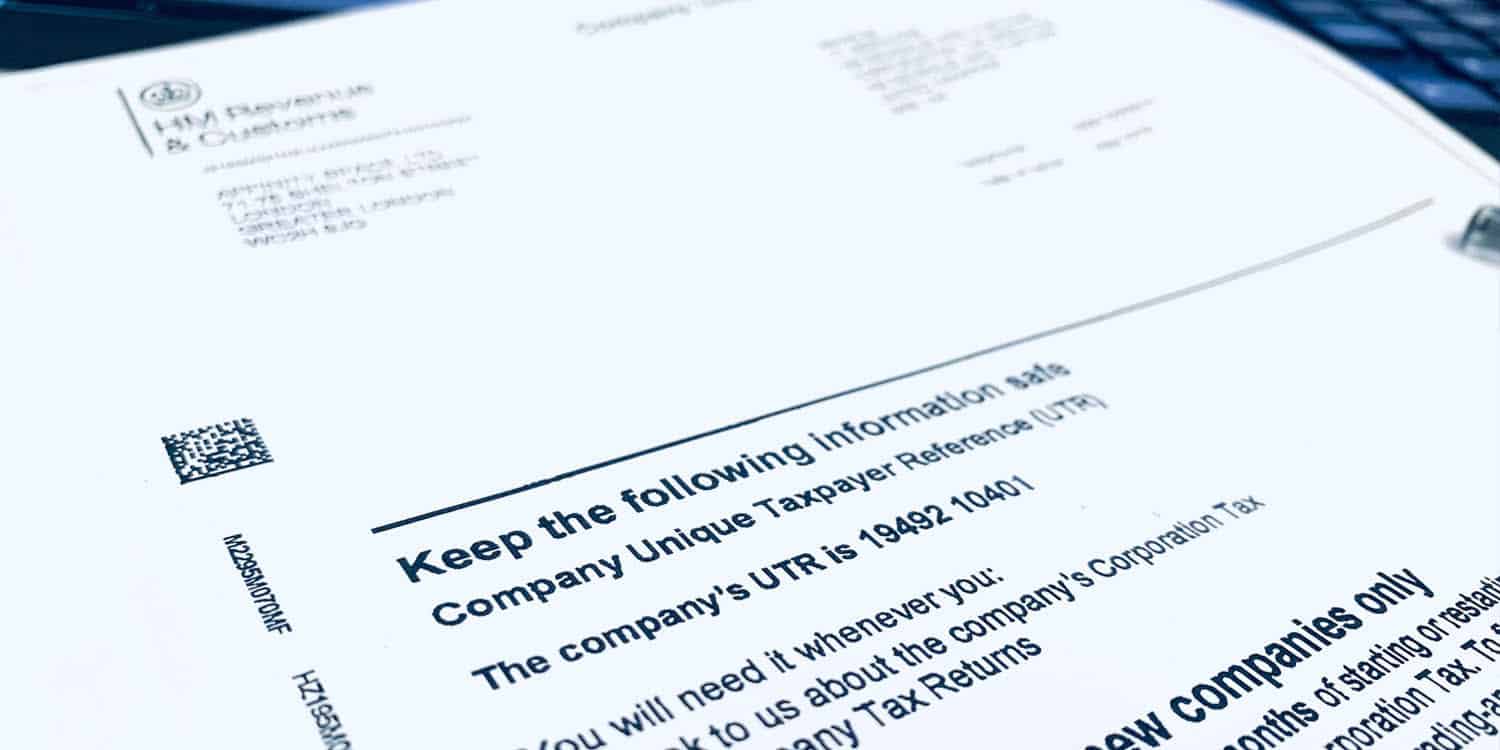

Companies House will notify HMRC when your new company has been incorporated. A unique taxpayer reference (UTR) will then be issued by HMRC and delivered to your registered office address within a few days of company formation. Your UTR will consist of ten numbers and it will be printed next to a heading such as ‘UTR’, ‘Tax reference’, or ‘Official use’.

Your company UTR will be stated on all future correspondence from HRMC, including the ‘Notice to deliver a Company Tax Return’. This tax reference is extremely important. You’ll be asked to provide it whenever you contact HMRC to help them identify your company and its tax obligations.

Information you must provide for HMRC

The letter that contains your UTR will include important information about registering your company for business taxes. When you begin trading, you must let HMRC know within 3 months. To do this, you must register your company online as ‘active’ for corporation tax and provide the following details about your business:

- Full name of your company as it appears on the certificate of incorporation

- Company registration number (CRN)

- The date you started trading (this is the date your company becomes ‘active’ for Corporation Tax)

- Address where your company carries out its main business activities

- Standard Industrial Classification (SIC) code (this is used to describe your company’s main business activities)

- Date to which your annual accounts will be ‘made up’ (normally the anniversary of company formation)

HMRC will use this information to determine your Corporation Tax accounting period and your deadlines for paying Corporation Tax and filing Company Tax Returns.

Corporation tax must be paid electronically within 9 months and 1 day after the end of each accounting period. Meanwhile, Company Tax Returns must be filed online along with full statutory accounts no later than 12 months after the end of each period.

Dormant company requirements

If your company is not trading (dormant), you should notify the Corporation Tax office at HMRC as soon as possible. You will find their contact details in the letter you received from HMRC.

You should not have to send any tax returns if your company is inactive, but you’ll still have to maintain certain filing obligations for Companies House, including completing an annual Confirmation Statement and filing dormant company accounts.