The owners of a company limited by shares must follow certain procedures when removing profit from the business. This is because, unlike sole trader businesses, limited companies exist as separate legal entities. All income belongs to the company until it is distributed to directors and shareholders as remuneration via permitted payment procedures such as salary payments and dividends.

You can extract all business profits as a director’s salary, but it is more tax-efficient to pay yourself a small salary and receive the rest of your income as dividends. The best way to do this is to take a salary up to your annual Personal Allowance, which is tax-free. This will also preserve your right to the State Pension and other benefits.

Key Takeaways

- Pay yourself a small salary up to your Personal Allowance for tax efficiency and to maintain State Pension eligibility.

- Declare dividends only if your company has sufficient retained profit; issuing them without profit is illegal.

- Consider splitting share ownership with a lower-earning partner to reduce higher-rate tax on dividends.

A company can issue dividends to its members (each member receiving payments in proportion to the shares held) at any time, provided the company has enough retained post-tax profit after all bills, costs, and expenses have been subtracted from turnover.

If there is no profit left in your business after allowing for these liabilities, you cannot issue dividends. If you do, the dividend will be deemed illegal and you could face severe consequences from HMRC. Salaries, however, can continue to be paid even if your company is making a loss, since this kind of payment is viewed as an allowable business expense.

Dividend Tax Calculator

Step 1: Declaring dividends

There are two types of dividends – interim and final. In most companies, the company directors must hold a board meeting to officially ‘declare’ interim dividends. To issue a final dividend, shareholders must grant their approval by passing an ordinary resolution at a general meeting or in writing.

It is beneficial and advisable to print out a copy of the balance sheet and profit and loss account for the period from which the profit will be distributed. This will ensure that payments do not exceed the available profit in the business bank account.

Step 2: Working out dividend payments

If your company has any profit remaining after paying all business taxes, expenses, and liabilities, you are free to distribute this money to shareholders. Dividends should be distributed according to each shareholder’s percentage of ownership. This is worked out by the number of shares they own, or otherwise in accordance with the company’s articles of association (e.g. where called-up share capital remains unpaid).

If you own 50% of your company’s shares, for example, you and the other shareholder are both entitled to dividends worth 50% of the retained profit. In this scenario, if your company has £2,000 of retained profit, you can both receive net dividends of up to £1,000 each.

Since your company will have already paid Corporation Tax on this income, the first £500 of dividends are tax-free (2025/26 dividend allowance). Above that amount, you will pay dividend tax. You must report this income and pay any necessary tax on an annual basis via Self Assessment.

Step 3: Issuing dividend vouchers

For each dividend a company issues, a voucher must be created and given to the shareholder. This voucher is sometimes referred to as a ‘dividend counterfoil’. It is not a special kind of form, but simply a piece of paper (or an electronic document attached to email) that provides the following important details about the payment:

- Name of company

- Company registration number

- Date of issue

- Name and address of shareholder receiving the payment

- Share class

- Amount of the dividend payment

- Signature of authorising officer

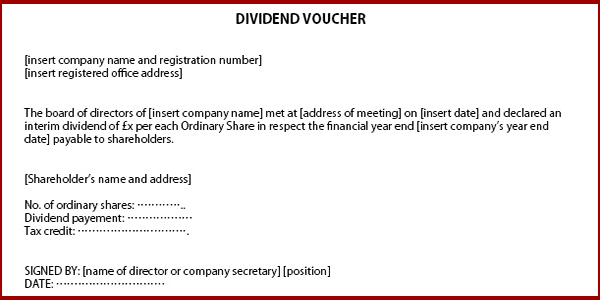

A typical example of a dividend voucher is as follows:

The same format can be used for interim and final dividends – simply alter the text accordingly.

Step 4: Preparing Minutes of Meetings

You must take minutes even if you’re the only director and shareholder in your company. All companies are legally required under the Companies Act 2006 to keep copies of meeting minutes with their statutory records for a minimum of 10 years. You may keep these minutes on paper, in some kind of electronic format, or both – whichever is most convenient.

How often can I issue dividends?

You can issue dividends as often as you like, provided that your company has sufficient retained profit to do so.

Due to the paperwork required, most accountants will advise you to issue interim dividends on a quarterly basis for easier record-keeping and to coincide with VAT payments. That being said, there is nothing to prevent you from issuing them more frequently if you really want to.

On the other hand, you may want to issue dividends annually at the end of each tax year, or at irregular intervals throughout the year when your company profits reach a certain level. It’s entirely up to you.

Dividends provide an excellent opportunity for effective tax planning. You can delay the distribution of profits until the following tax year, which is beneficial if you want to keep your income within the basic rate of tax, or you plan to work more than one year and take some time off the next.

You may also wish to consider, if possible, splitting ownership of your business with your significant other if they earn significantly less than you. This will allow you to issue dividends to him or her, thus avoiding or paying less higher-rate tax.

Is there a limit to the number of dividends a company can issue?

No, there is no limit to the number of dividends a company can issue throughout the year or at any one time. However, it does depend on the number of shareholders your company has and the amount of retained profit available to distribute.

You’re only required to issue one dividend per shareholder each time you declare dividends, and you cannot issue them if your company does not have any retained profit to distribute.

It’s also worth bearing in mind that the more dividends you issue, the more paperwork you will have to fill out. You’ll also need to spend more time on your Self Assessment tax return. Keep it as simple as possible. Ideally, you should speak to an accountant for tailored, expert advice.

Corporation Tax Calculator

How are dividends taxed?

All taxpayers are required to pay tax on dividends above £500. The rates are based on Income Tax bands and thresholds. The current rates are as follows:

- Basic rate – 8.75%

- Higher rate – 33.75%

- Additional rate – 39.35%

The Income Tax and National Insurance contributions you will pay on your director’s salary are not payable on dividends, but you must include your relevant income in the ‘Dividends’ section of your Self Assessment tax return each year. This will allow you to work out and report your total earnings for the tax year.

If your total annual income (from all sources, including dividends) for the 2025/26 tax year is £12,570 or less, you will not pay any dividend tax because it falls within your tax-free Personal Allowance of £12,570.

Do I need to issue dividends?

If you are the only shareholder in your company, there is no legal requirement for you to issue dividends if you don’t want to. You can retain surplus income in the company to further the aims of your business, or you can take your entire income as a director’s salary. However, it is not tax-efficient to pay yourself a salary above your tax-free Personal Allowance.

If you’re not the only shareholder in the company, you cannot make that decision by yourself. If there is available profit to distribute, the rest of your company’s shareholders may want to see a return on their investment. Such matters should be formally discussed and agreed upon.

Please note that the information provided in this article is for general informational purposes only and does not constitute legal, tax, or professional advice. While our aim is that the content is accurate and up to date, it should not be relied upon as a substitute for tailored advice from qualified professionals. We strongly recommend that you seek independent legal and tax advice specific to your circumstances before acting on any information contained in this article. We accept no responsibility or liability for any loss or damage that may result from your reliance on the information provided in this article. Use of the information contained in this article is entirely at your own risk.

Join The Discussion

Comments (26)

Hi,

Can I query the point that dividends must be paid within 9-months after the year end (ARD)?

We have been informed by our auditors that there is no deadline for this and can stay in a loan account for as long as required. They are dividends owed by a subsidiary to a parent company. Can you explain what the law is, where it is stated and what are the implications if the dividends are not fully paid 9-months after the year end?

Thank you!

Thank you for taking the time to comment.

And thank you for pointing this out, it is much appreciated.

We have now updated this section of the blog post.

Kind regards,

The QCF Team

Can I pay dividends before I have paid any corporation tax as the company is in its first trading year. Currently I have generated profit of 20000 (which will become around 16000 after tax) and have no debts or payments to make as the business is quite simple. Can the company pay shareholders (including myself) a dividend now to make use of their 2000 tax free allowance in this tax year. The total dividends would be under 5000- so would leave plenty of money to pay the corporation tax when it becomes due…

Thanks for the question Andy.

The Companies Act 2006 allows companies to pay its members dividends, which are paid out of the company’s post-tax profits.

We would therefore expect corporation tax to be paid before the dividend is paid. Having said that, we urge you to investigate this further as all cases differ.

Regards,

The QCF Team

great advise question what about a sole propierter if i leave my bussiness to my neice can i declare divs per mo. ( ie. i own all 100 shares ) and her send me 10,000 per mo as div. income can she deduct this as expense? also profit is around 20,000 per mo she could keep difference and pay her tax rate as income correct ? thanks todd

Thank you for your kind enquiry, Todd.

If your company has distributable profit of over 10,000 per month, it can declare dividends of that whenever it wishes. However, with regards your niece’s income, the distributable profit is calculated after salary. In your scenario your niece would be unable to benefit from dividends as she would own no shares in your company, and therefore would have to earn her money via PAYE, which would be taxed via income tax; however, distributable reserves (from which you pay dividends) are calculated after salaries have been deducted.

Please do not hesitate to contact us if you require further clarification.

Regards,

The QCF Team

Hello,

What if in the following scenario:

Year 1: One shareholder has 100%. Profit are X but not dividend are paid. (Profit is retained)

Year 2: A new shareholder comes is, with Y% of the shares. The company issues dividends, to pay out the retained profit of Year 1.

Can the new shareholder get dividends from Year 1 retained profits, despite he has joined the company on Year 2?

Thanks

Thank you for your kind enquiry, Tony.

In general terms, there is no restriction on a new shareholder getting dividends from a previous year’s profit – however, you must ensure that the amount of dividends issued is no greater than the amount of retained profits in year 1 plus any profit in year 2, as this would be illegal. With regards issuing dividends relating to when the profit was earnt (i.e. where it was earnt prior to a shareholder owning shares in the business), there is no stipulation that owning shares in the business at the times the profit was earnt is a requirement for receiving a dividend from retained profits. However, you should ensure that issuing dividends to the new shareholder in your scenario does not conflict with the company’s articles of association, shareholders’ agreements or pre-emption rights which some shareholders may have.

I trust this information is of use to you.

Regards,

Nicholas

Hi. Can a company issue Dividend in Specie or Dividend in Kind ? If allowable, how shall it be conducted. Thanks

Thank you for your kind enquiry, Mark.

If your company has used the Model Articles of Association, it can pay dividends in specie out of distributable reserves. If the Model Articles were used, this can be recommended by the directors of the company and declared by members via a written resolution. The value of the dividend in specie declared by shareholders cannot exceed the value recommended by the directors. If your company has not used the Model Articles, you should check to ensure there is nothing prohibiting dividend in specie, and that there is nothing stating how these may be declared.

Kind regards,

Nicholas

I trust this information i

Excellent article. Very useful and very well explain!

We’re glad you found our article useful, Saudy.

Kind regards,

Graeme

Hello,

Thank you for this article. Is there a general convention for naming dividend payments? For example with quarterly dividends, is it conventional to name/label them for the quarter when the profits were earned, the quarter of the declaration date or the quarter of the payment date (if different)?

Many thanks.

Dear Frank,

In general terms, dividends are named either ‘Final Dividends’ (those at the end of the financial year) and ‘Interim Dividends’ (those paid throughout the year). The company is of course at liberty to declare as many dividends as they wish, so they are sometimes referred to by their frequency (e.g. in your case, quarterly).

Graeme at Quality Company Formations

Hi, if Alphabet shares were issued, is it possible for one shareholder of 50% of the business to receive dividends and the other shareholder of 50% to receive none?

Thanks,

Jon.

Hi Jon

Thank you for your message.

Dividends do not need to be declared to all shareholders if they have different alphabet shares.

Best regards,

Great article and very helpful, does the dividend need to be featured in the company return or just declared through self-assessment?

Hi Ryan

Thank you for your message.

A dividend needs to be declared in accounts as well as your Self Assessment tax return.

Best Regards,

I am a shareholder in a company (a minority but over 10% equity). My co director (main shareholder) paid himself the entire dividend. The director did not include me in a board meeting and I only found out after the company accounts were supplied. What do you suggest? Thanks

Dear Alistair,

We are not accountants/solicitors unfortunately so cannot advise on matters such as this so we can only suggest that you seek specialist advice on the matter.

Best regards,

Quality Formations Team

My company made a profit in the year 2015/16 which ended 31.3.16 but declared no dividend in that year as the true cash position was not good. This has now improved and we would like to declare a dividend now, but the ARD is now past. Does this mean we must declare it as an interim dividend on the current year rather than final on the last?

Dear Peter,

Unfortunately we are not accountants so cannot advise on the treatment of your dividends. I would suggest you contact an accountant about this.

Best regards,

Quality Formations Team

Hi, I’ve just left a company I had a 20% equity share in and have been told my fellow shareholders paid themselves an interim dividend without paying me. I assume this is illegal and also negates any shareholders agreement we had? I also received no notification of their actions.

Dear Andy,

We are not accountants/solicitors unfortunately so cannot advise on matters such as this so we can only suggest that you seek specialist advice on the matter.

Best regards,

Quality Formations Team

This writing is very helpful. I have one question. If there is 2 directors in a corp, share is equal. And one director want to take dividend for current year; but another director does not want for that year; is that possible?

Dear Anamika,

Thank you for your kind comments.

In terms of 1 director taking dividends without the other, as we are not accountants we cannot advise on this however I think there may be an option for a “dividend waiver” or if you wanted to issue different classes of shares to different people which had different rights then that would likely be an option. I would suggest speaking to an accountant to work out what is best in your particular circumstances.

Kind Regards